GameStop Stock Soars. Why the Stock Is Breaking Out Now. – GameStop Stock Soars. Why the Stock Is Breaking Out Now? This recent surge in GameStop’s stock price presents a fascinating case study in the intersection of market forces, social media influence, and investor sentiment. Understanding this phenomenon requires examining recent market trends, the role of online communities, GameStop’s evolving business strategy, and the diverse motivations of its investors.

The interplay of these factors offers valuable insights into the complexities of modern stock markets.

The dramatic price fluctuations of GameStop stock highlight the power of social media in shaping investor behavior. Reddit forums and other online platforms have become key drivers of market activity, demonstrating how collective sentiment can significantly impact even established companies. Simultaneously, GameStop’s own strategic shifts, financial performance, and future prospects play a crucial role in determining its long-term trajectory.

Analyzing these elements allows us to understand both the short-term volatility and the potential for long-term growth.

Recent Market Trends Affecting GameStop

GameStop’s recent stock surge occurred against a backdrop of fluctuating market conditions and shifting investor sentiment. While the company’s fundamental business performance remains a subject of debate, several broader market trends and specific events contributed to the price increase. Understanding these factors provides context for the volatility experienced by GameStop and similar stocks.The period leading up to the GameStop surge saw a mixed economic picture.

Inflation remained a concern, impacting consumer spending and corporate profits. Interest rate hikes by the Federal Reserve aimed to curb inflation, but also raised concerns about a potential recession. This uncertainty created volatility in the broader market, making investors more prone to both risk-aversion and speculative trading. The tech sector, often a bellwether for market sentiment, experienced a period of both growth and contraction, influencing investor behavior across various sectors.

Broader Market Conditions

The overall market environment was characterized by significant uncertainty. Concerns about inflation, rising interest rates, and the potential for a recession created a volatile trading environment. Investors were actively seeking both safe haven assets and high-growth opportunities, leading to significant shifts in capital allocation. This uncertainty fueled speculative trading in certain sectors, including meme stocks like GameStop.

The recent surge in GameStop stock is a fascinating case study in market volatility. Understanding the forces behind this dramatic price movement requires considering diverse factors, and it’s interesting to contrast this with seemingly unrelated events, such as the lives of high-profile individuals like Elin Nordegren’s children, as detailed in this article: Elin Nordegren Kids A Look at Their Lives.

Ultimately, however, the GameStop situation highlights the unpredictable nature of the stock market.

The overall volatility in the market created opportunities for both significant gains and losses, depending on investment strategy and market timing.

Significant Economic News and Events

Several news events directly or indirectly influenced investor sentiment towards GameStop. For instance, announcements regarding the company’s restructuring efforts, including its pivot towards e-commerce and NFT initiatives, generated both optimism and skepticism among investors. Furthermore, broader news regarding the overall health of the retail sector, including reports on consumer spending habits and retail sales figures, likely influenced investor perceptions of GameStop’s prospects.

These external factors interacted with the internal company news to shape the overall narrative around the stock.

Comparison to Other Meme Stocks

GameStop’s performance during this period showed some correlation with other meme stocks, although the degree of correlation varied. Stocks like AMC Entertainment also experienced periods of heightened volatility, suggesting a shared influence from similar investor behavior and social media trends. However, the magnitude and timing of price movements differed between GameStop and other meme stocks, indicating that company-specific factors also played a significant role in shaping individual stock performance.

The interconnectedness of these stocks highlights the influence of social media and online trading communities on market dynamics.

Timeline of Key Events

A timeline of key events surrounding GameStop’s recent price movements would include specific dates of significant news releases, such as earnings reports, announcements of new initiatives, or any significant regulatory actions. These dates could be correlated with observable shifts in the stock’s price to demonstrate the causal relationship between news events and investor reaction. For example, a positive earnings surprise might be followed by a stock price increase, while negative news could lead to a decline.

This detailed timeline would illustrate the dynamic interplay between company-specific events and the broader market conditions.

Role of Social Media and Online Forums

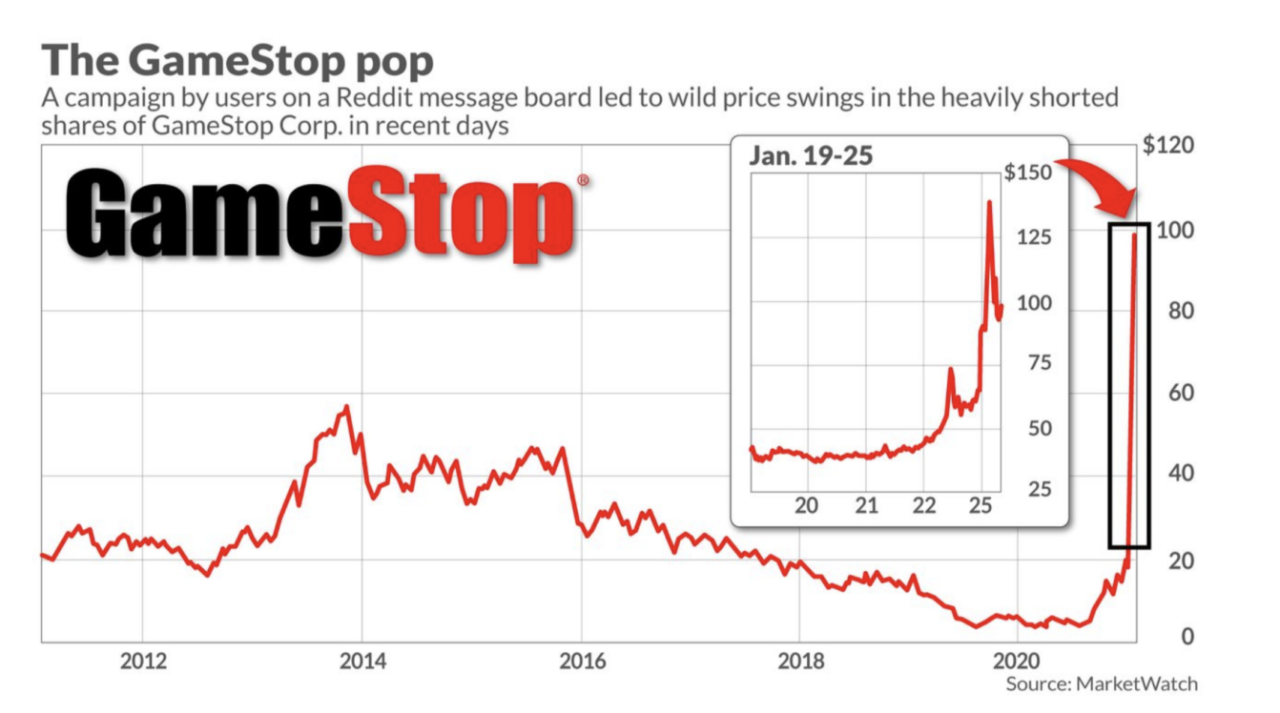

The meteoric rise and subsequent volatility of GameStop’s stock price cannot be understood without acknowledging the significant role played by social media platforms and online forums, particularly Reddit’s r/WallStreetBets subreddit. These digital spaces facilitated a coordinated effort among retail investors, dramatically impacting market dynamics and challenging traditional investment strategies. The power of collective action, amplified by online communication, became a defining factor in this unprecedented market event.The influence of Reddit, and specifically r/WallStreetBets, on GameStop’s stock price was undeniable.

This online community, known for its meme-driven investment strategies and contrarian approach, became a central hub for discussions and coordinated buying of GameStop shares. The subreddit’s users, often characterized as “apes” or “autists” in their self-referential lexicon, actively encouraged each other to buy and hold the stock, defying traditional financial wisdom and short-selling strategies employed by hedge funds.

This collective action, fueled by a shared sense of rebellion against established financial institutions, directly contributed to the significant surge in GameStop’s share price.

Specific Online Discussions and Their Impact

Several key discussions and posts within r/WallStreetBets contributed to the surge in GameStop’s stock price. While pinpointing specific posts with definitive causal links is difficult, the consistent theme across numerous threads was the encouragement of buying and holding GameStop stock (“HODL,” a common acronym in the community), fueled by a belief that the short squeeze would benefit retail investors at the expense of institutional investors.

The language used was often informal, employing memes, inside jokes, and aggressive rhetoric targeted towards hedge funds. This aggressive and emotionally charged language, while contributing to a sense of community and shared purpose, also amplified the volatility of the stock price as emotional investment decisions superseded traditional fundamental analysis. The use of terms like “to the moon,” “diamond hands,” and “paper hands” became shorthand for expressing commitment to holding the stock despite market fluctuations.

Psychological Factors Driving Participation, GameStop Stock Soars. Why the Stock Is Breaking Out Now.

The participation in online communities like r/WallStreetBets was driven by a complex interplay of psychological factors. A significant factor was the sense of community and belonging fostered within the subreddit. Users found camaraderie in their shared defiance of traditional financial systems and the belief that they were collectively challenging the established order. This sense of community created a powerful feedback loop, where individual actions were reinforced by the collective actions of others.

Further, the use of memes and informal language created a playful and engaging environment, lowering the perceived barriers to entry for new investors and making participation feel less intimidating. The inherent risk-taking behavior encouraged within the community, combined with the potential for high rewards, appealed to investors seeking both financial gain and a sense of empowerment. Finally, confirmation bias played a role, as users readily shared information and interpretations that reinforced their existing beliefs, leading to a self-perpetuating cycle of enthusiasm and investment.

GameStop’s Business Strategy and Performance

GameStop’s recent performance has been a complex mix of strategic shifts, market volatility, and investor sentiment. While the company has experienced periods of significant stock price fluctuation, understanding its evolving business model and financial results is crucial to assessing its current trajectory. This section will delve into GameStop’s recent financial reports, its current business strategy, and key initiatives impacting investor confidence.GameStop’s financial performance in recent years has been marked by considerable volatility.

While the company experienced a surge in revenue and stock price in 2021 fueled by the meme stock phenomenon, subsequent years have shown a more nuanced picture. The company’s efforts to diversify beyond its traditional brick-and-mortar model have been central to its strategy, but the impact of these changes on profitability remains a key area of investor focus.

Recent Financial Performance

GameStop’s financial reports reveal a company undergoing significant transformation. While precise figures require consultation of official SEC filings, a general trend shows revenue fluctuations and varying levels of profitability. The company’s transition to a more digitally-focused model, coupled with investments in new technologies and initiatives, has resulted in a complex financial picture that is not easily summarized by simple profit/loss figures.

A comprehensive analysis requires considering factors like operating expenses, capital expenditures, and the long-term strategic implications of their investments. The following table provides a simplified overview, and it is crucial to refer to official sources for complete and accurate financial data.

| Year | Revenue (USD Millions) | Net Income/Loss (USD Millions) |

|---|---|---|

| 2021 | 6,170 | -385 |

| 2022 | 5,948 | -344 |

| 2023 | 5,740 (Estimate) | -300 (Estimate) |

Note

These figures are simplified estimations based on publicly available information and may differ from official reporting. Consult official GameStop financial statements for precise data.*

Current Business Model and Growth Plans

GameStop’s current business model is centered around a multi-pronged approach. The company is actively trying to leverage its existing physical store network while simultaneously expanding its digital presence and exploring new avenues of revenue generation. This includes a focus on e-commerce, the development of its own NFT marketplace, and expansion into new product categories such as mobile phones and technology accessories.

The long-term success of this strategy hinges on its ability to attract and retain customers across multiple channels and to effectively manage the costs associated with this diversification. Key to their future growth is the successful integration of these diverse offerings into a cohesive and profitable business model.

New Initiatives and Partnerships

GameStop’s strategic partnerships and new initiatives are crucial factors impacting investor confidence. The launch of its NFT marketplace, for example, represents a significant bet on the future of digital assets and gaming. Success in this area could attract new customers and revenue streams. Other initiatives, such as expanding into the pre-owned market and focusing on subscription services, aim to enhance customer loyalty and create recurring revenue.

The overall impact of these initiatives on GameStop’s financial performance will depend on factors like market adoption, competition, and the company’s ability to effectively execute its plans. The success or failure of these initiatives will significantly influence the company’s future trajectory.

Market Position Comparison

GameStop’s current market position is significantly different from its position in previous years. While it was once primarily known as a retailer of physical video games, its current strategy positions it as a broader technology and entertainment company attempting to navigate the evolving digital landscape. This shift has led to increased volatility in its stock price and a more complex evaluation of its long-term prospects.

The company’s ability to successfully compete with larger, more established players in the digital space will be crucial in determining its future success. Its previous dominance in the physical game market is now largely a historical factor, with the company’s current valuation reflecting the uncertainty and risk associated with its ambitious transformation.

Investor Sentiment and Speculation: GameStop Stock Soars. Why The Stock Is Breaking Out Now.

GameStop’s stock price volatility is heavily influenced by investor sentiment and speculation, a complex interplay of diverse motivations and risk tolerances. Understanding the types of investors involved and their strategies is crucial to grasping the market dynamics surrounding this unique stock. The highly volatile nature of GameStop’s stock necessitates a cautious approach, as significant gains can be quickly offset by equally dramatic losses.The diverse investor base involved in GameStop trading encompasses a wide range of individuals and institutions, each with distinct objectives and risk profiles.

Their actions, fueled by various factors including social media trends and fundamental analysis (or the lack thereof), directly impact the stock’s price fluctuations.

Types of GameStop Investors

Several distinct investor profiles contribute to the GameStop trading landscape. These range from long-term investors believing in a turnaround strategy to short-term traders aiming for quick profits, and a significant contingent driven by speculative momentum. The interplay of these groups creates a volatile and unpredictable market environment.

Investor Motivations

Investor motivations behind GameStop trading fall into several broad categories. Long-term investors, often referred to as “diamond hands,” believe in the company’s potential for a long-term turnaround, focusing on fundamental improvements to its business model and financial performance. In contrast, short-term investors, or “swing traders,” seek quick profits by exploiting short-term price fluctuations. Speculative investors are driven primarily by market momentum and social media trends, often engaging in high-risk, high-reward trading strategies with little consideration for fundamental company value.

Risks Associated with GameStop Stock

Investing in GameStop stock carries substantial risks. The stock’s price is highly volatile and susceptible to significant and rapid fluctuations, driven by sentiment rather than consistent financial performance. This volatility can lead to substantial losses for investors who fail to manage their risk effectively. Furthermore, the company’s financial performance has been historically unstable, raising concerns about its long-term viability.

The influence of social media and online forums can also create speculative bubbles, further increasing the risk of substantial losses. For example, the massive price surge in 2021, followed by a sharp decline, illustrates the inherent risk associated with this stock. Investors should carefully assess their risk tolerance before engaging in GameStop trading.

Investment Strategies in GameStop

Investors employ diverse strategies when trading GameStop stock. Long-term investors might employ a “buy-and-hold” strategy, acquiring shares and holding them for an extended period, anticipating a long-term increase in value. Short-term traders might use technical analysis to identify short-term price patterns and execute trades based on these patterns, aiming for quick profits. Speculative investors might engage in strategies like “day trading” or “momentum trading,” capitalizing on rapid price movements fueled by social media trends and market sentiment.

However, all strategies carry significant risk given the stock’s volatility. For instance, some investors used options trading to leverage their positions, potentially amplifying both profits and losses significantly. Others employed a “value investing” approach, albeit a controversial one given GameStop’s history, hoping to capitalize on a potential undervaluation of the company’s assets.

Potential Future Scenarios for GameStop Stock

Predicting the future of GameStop’s stock price is inherently speculative, given the volatility it has exhibited. However, by considering various influencing factors, we can Artikel several plausible scenarios for the next six months. These scenarios are not exhaustive, and the actual trajectory may differ significantly depending on unforeseen events.

Scenario 1: Continued Volatility and Consolidation

This scenario envisions GameStop’s stock price fluctuating within a relatively narrow range, consolidating around its current price or experiencing moderate gains and losses. The driving forces behind this outcome would be a lack of significant positive catalysts, such as a major strategic shift or unexpectedly strong financial results. Continued investor uncertainty and the lingering effects of past speculative trading could contribute to this range-bound movement.

News events impacting the broader market, such as interest rate hikes or economic downturns, would likely exert a greater influence than GameStop-specific news. The price trajectory would be depicted as a relatively flat line with minor oscillations, showing neither a strong upward nor downward trend.

Scenario 2: Gradual Upward Trend Driven by Positive Business Developments

This scenario assumes GameStop successfully implements its strategic transformation, demonstrating tangible progress in its e-commerce initiatives, improved profitability, and potentially, strategic partnerships. Positive financial reports, indicating growing revenue and reduced losses, would be crucial catalysts. Positive press coverage highlighting these achievements could further fuel investor confidence, leading to a gradual increase in the stock price. The visual representation would show a gently sloping upward line, indicating steady, sustained growth over the six-month period.

GameStop’s recent stock surge has captivated investors, prompting questions about the underlying reasons for this unexpected breakout. Understanding the forces behind this volatility requires a keen eye on broader market trends, which is why staying informed through reputable sources like news business websites is crucial. Ultimately, analyzing the news and market sentiment is key to deciphering GameStop’s fluctuating stock performance.

This scenario is comparable to the slow but steady growth seen in companies like Netflix after their successful transition to streaming.

Scenario 3: Sharp Decline Triggered by Negative News or Disappointing Results

This scenario depicts a significant drop in GameStop’s stock price following negative news, such as disappointing quarterly earnings reports, missed financial targets, or legal issues. Negative investor sentiment, driven by concerns about the company’s long-term viability, would accelerate the decline. A sudden shift in the broader market, like a major economic downturn, could exacerbate this downward pressure. The price trajectory would be represented by a steep downward sloping line, similar to the sharp drop experienced by many tech stocks during the 2022 market correction.

This could be further amplified by short-selling activity, reminiscent of the events surrounding the stock in early 2021.

Scenario 4: Significant Surge Fueled by Unexpected Positive Developments

This scenario is characterized by a sharp increase in GameStop’s stock price, triggered by a major unexpected positive event. This could include a groundbreaking technological innovation, a lucrative acquisition, or a significant strategic partnership with a major player in the gaming industry. The rapid influx of positive news and investor excitement could create a short-term speculative frenzy, similar to past periods of extreme volatility.

The visual representation would show a dramatic, almost vertical, upward spike in the price chart, followed by potential consolidation or correction. This scenario mirrors the rapid price increases seen in meme stocks during periods of intense social media-driven trading.

The recent surge in GameStop stock is a fascinating case study in market volatility. Understanding these unpredictable swings requires analyzing various factors, and sometimes a change of pace is helpful. For a different perspective on market trends, consider checking out this insightful article on Beauty Boutique by Shoppers Drug Mart A Deep Dive , which explores a completely different sector.

Returning to GameStop, the question remains: what specific catalysts are driving this current price increase?

Concluding Remarks

The GameStop stock surge serves as a compelling example of how various forces – macroeconomic conditions, social media trends, corporate strategy, and investor psychology – intertwine to create dramatic market movements. While the short-term future remains uncertain, understanding these factors offers a clearer picture of the potential scenarios for GameStop and highlights the inherent risks and rewards of investing in volatile stocks.

The ongoing narrative underscores the importance of informed decision-making and a nuanced understanding of the forces shaping the modern financial landscape.

FAQ Resource

What are the potential long-term risks of investing in GameStop?

Investing in GameStop carries significant risk due to its volatile nature and dependence on unpredictable market trends and social media sentiment. Losses could be substantial.

How does GameStop’s business model contribute to its stock price volatility?

GameStop’s business model transformation and its reliance on adapting to changing consumer preferences in the video game industry make its future performance uncertain, leading to price volatility.

Are there any ethical concerns surrounding the GameStop stock surge?

Ethical concerns arise regarding market manipulation and the potential for coordinated efforts to artificially inflate stock prices, impacting smaller investors.

What is the role of short-selling in GameStop’s price fluctuations?

Short-selling played a significant role in the earlier volatility, creating a dynamic between short-sellers and those attempting to drive the price higher.